China’s domestic battery-grade lithium carbonate prices rose by 5.6% to a 14-month high on Thursday January 14, 2021 on tightening spot supply while battery-grade lithium hydroxide also surged by 10.3

China’s domestic battery-grade lithium carbonate prices rose by 5.6% to a 14-month high on Thursday January 14, 2021 on tightening spot supply while battery-grade lithium hydroxide also surged by 10.3% week on week on low availability of cheap materials, Fastmarkets heard.

China’s battery-grade lithium carbonate price hit a 14-month high on reduced spot supply, with most producers insisting on higher prices.

China’s industrial-grade lithium carbonate prices rose further while buyers found it hard to get spot material due to tight supply.

China’s lithium hydroxide prices surged as a result of low availability of cheap materials.

The Asian industry-grade lithium spot market similar increased on tight supply.

China’s battery-grade lithium carbonate prices surged due to producers’ limited availability of spot materials while most buyers were cautious of higher prices and only purchased small volumes for immediate need, sources said.

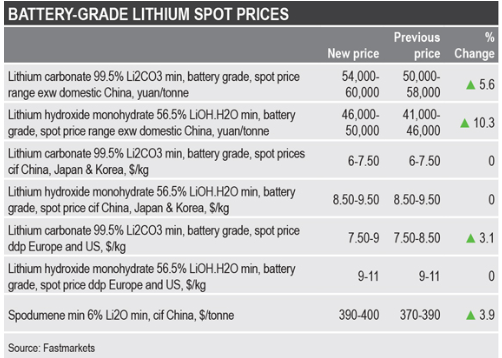

Fastmarkets’ weekly price assessment for lithium carbonate, 99.5% Li2CO3 min, battery grade, spot price range exw domestic China was 54,000-60,000 yuan ($8,343-9,270) per tonne on Thursday January 14, up 5.6% from 50,000-58,000 yuan per tonne the previous week. The market was trading at its highest since November 7, 2019, when it stood at 54,000-57,000 yuan per tonne.

“Currently, most producers are offering battery-grade lithium carbonate above 60,000 yuan per tonne, and I hear offers at 63,000-65,000 yuan per tonne as well. But we’re in no hurry to purchase materials and will monitor the market and restart purchases after China’s Lunar New Year in late February,” a buyer told Fastmarkets.

Market participants said offers in China’s technical and industrial-grade lithium carbonate market move up to 55,000-60,000 yuan per tonne, but most producers had no material for spot sales.

Fastmarkets assessed the Chinese technical and industrial-grade lithium carbonate spot price at 45,000-52,000 yuan per tonne on Thursday, rising from 42,000-48,000 yuan per tonne on January 8.

The battery-grade lithium hydroxide prices significantly increased this week with most cheap materials disappearing on the spot market, sources said, adding that most producers pushed offer prices above 50,000 yuan per tonne due to falling stocks.

Fastmarkets’ lithium hydroxide monohydrate, 56.5% LiOH.H2O min, battery grade, spot price range exw domestic China was at 46,000-50,000 yuan per tonne on Thursday January 14, up from 41,000-46,000 yuan per tonne the previous week following eight weeks of stability.

Battery-grade lithium carbonate prices have gradually surpassed hydroxide prices since early December last year. The price gap widened amid increasing appetite for carbonate from cathode makers and flat demand from the high-nickel ternary sector, sources said.

After lingering in a low-price environment for eight weeks, however, downstream buyers started to restock more material after the continuous surge on carbonate. Most producers basically sold out most of their accumulated stocks for hydroxide late last year so started to push up prices as well, Fastmarkets heard.

“We basically have no material on hand because most hydroxide has been sold out. Current offer prices are all above 50,000 yuan per tonne and supply is tight,” a producer said.

Battery-grade lithium carbonate rebounds on tighter spot availability

The Europe, US battery-grade lithium carbonate spot market widened up with strength from the technical-grade carbonate equivalent filtering through amid tighter availability in the carbonate complex, sources said.

Battery-grade lithium hydroxide prices, however, remained steady while spot demand in Europe and the United States for the battery raw material remains marginal.

Fastmarkets' latest price assessment for lithium carbonate 99.5% Li2CO3 min, battery grade, spot price ddp Europe and US was $7.50-9 per kg on Thursday January 14, up from $7.50-8.50 per kg the previous session. The last time the assessment stood at $7.50-9 per kg was on September 17, historical pricing data showed.

Fastmarkets' latest price assessment for lithium hydroxide monohydrate 56.5% LiOH.H2O min, battery grade, spot price ddp Europe and US was $9-11 per kg on Thursday January 14, unchanged for seven consecutive sessions.

Meanwhile, spot prices for lithium technical and industrial-grade in Europe and the US continue to increase amid tighter supply and the rising domestic Chinese prices.

Fastmarkets assessed the lithium carbonate 99% Li2CO3 min, technical and industrial grades, spot price ddp Europe and US at $6.50-8 per kg on January 14, up from $6.50-7.50 per kg the previous week.

“Customers are asking different suppliers to get a better price, that or some of them can’t get the quantities they need so they’re try with other suppliers. We’ve been seeing this lately either because of the price [increases] or a lack of availability,” a seller of

lithium compounds active in Europe said.

Leave A Comment